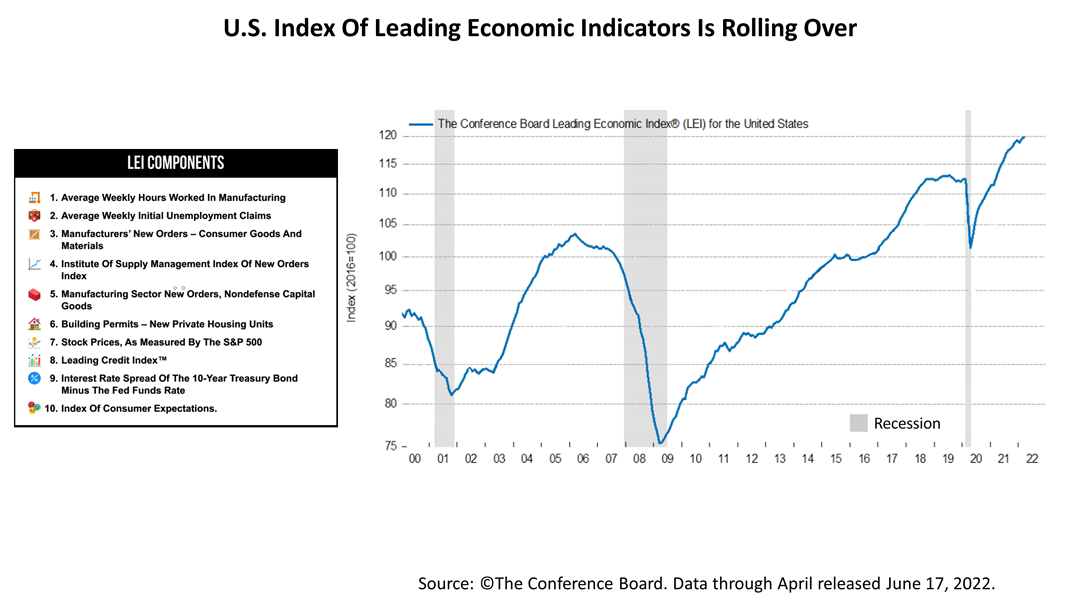

In an ominous sign a recession is on the way, the U.S. Index of Leading Economic Indicators ticked down four-tenths of 1% in May, following a decline of four-tenths of 1% in April.

The LEI has a history of rolling over definitively before every recession since 1950, except for the Covid-19 recession. Comprised of 10 indexes, the LEI is a reliable forward-looking indicator of the foreseeable future. The LEI was doing just fine until April, and May’s drop is one of a few influential economic growth indicators to turn negative in the last couple of weeks.

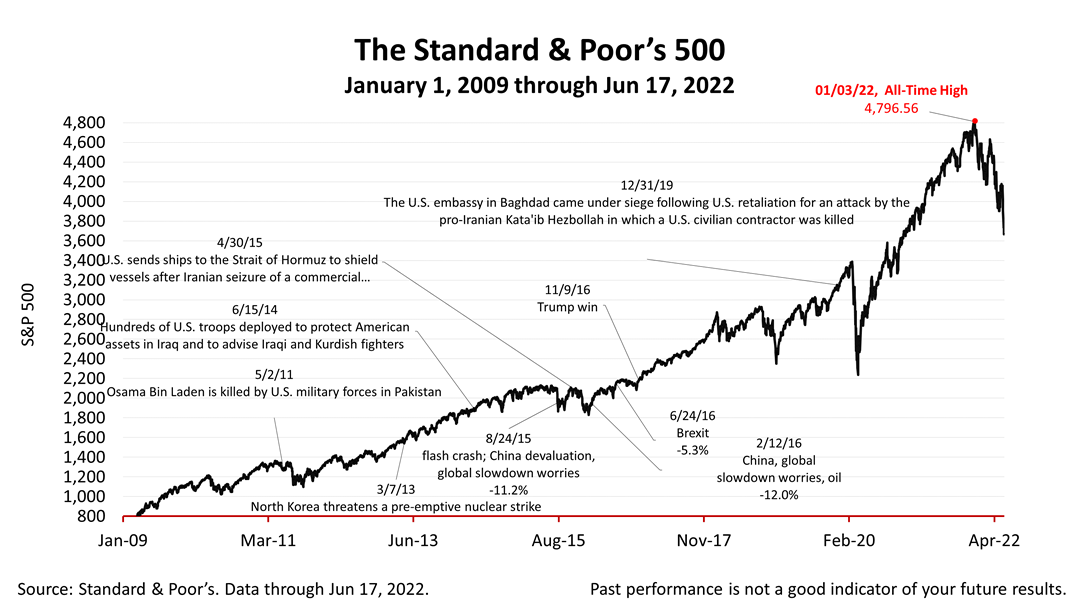

The Standard & Poor’s 500 index is one of the 10 components in the LEI. The plunge in stock prices in anticipation of an economic slowdown was a key factor accounting for the slump of the LEI for the past two months.

Financial news headlines were uniformly bad an hour after the close of trading on Friday. The bad week for stocks will show up on next month’s LEI, an ominous sign.

The Standard & Poor’s 500 stock index closed this Friday at 3,674.84. The index gained +0.22% from Thursday but plunged -5.96% from a week earlier. The index is up +48.62% from the March 23, 2020, bear market low and down -26.48% from the January 3rd all-time high.

With gloom and doom now saturating the media and national financial psyche, bright spots remain: Household balance sheets are strong and the ability of American to pay their monthly expenses remains extremely strong by historical standards; consumers continue spending; and state government are flush with cash due to the unexpected Covid expansion. Stay focused on the next economic recovery.